does idaho have capital gains tax

208 334-7660 or 800 972-7660 Fax. These would just be taxed as normal income.

Capital Gains Tax Estimator East Idaho Wealth Management

Single people can qualify for up.

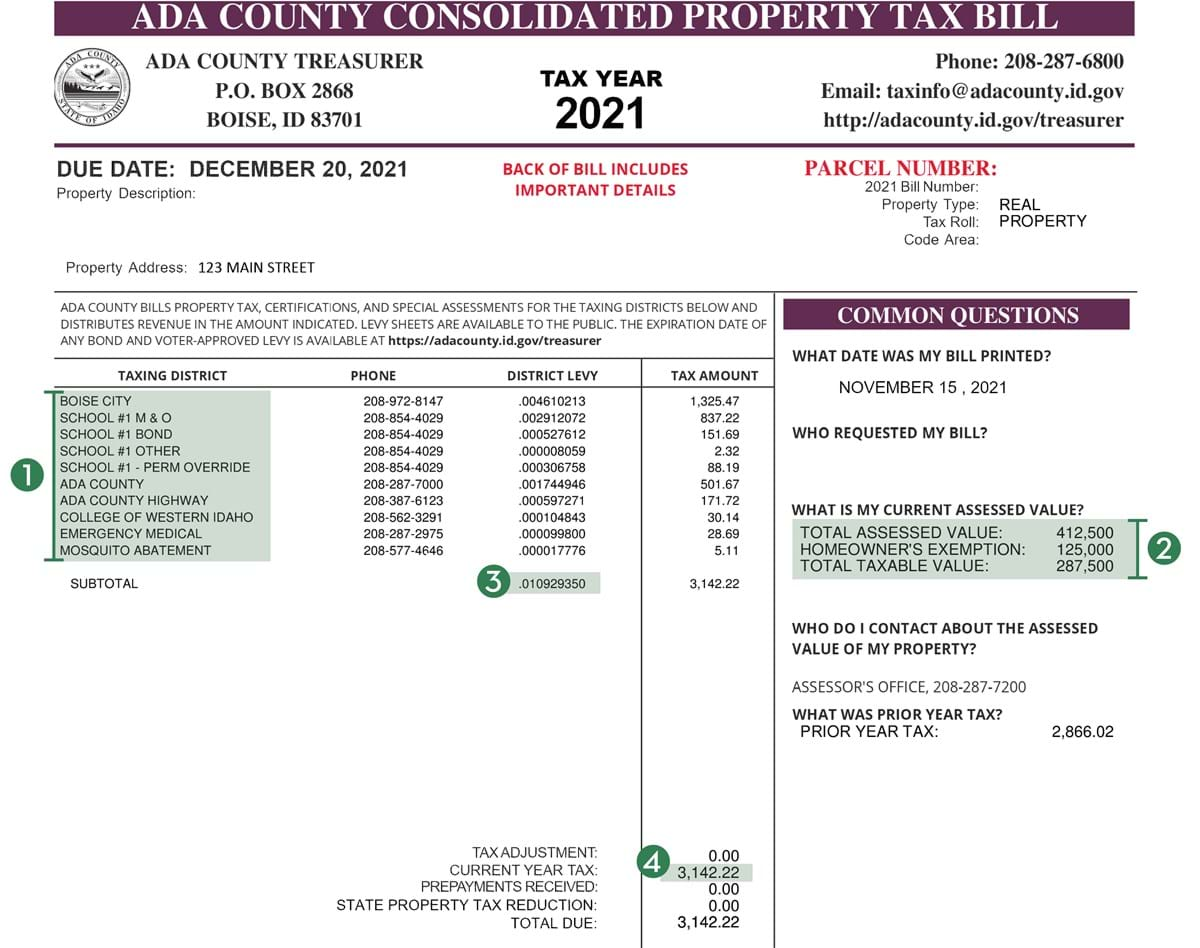

. Section 63-105 Idaho Code Powers and Duties - General Income Tax. A calendar year contains 365 days therefore 3000365 822 property tax per day of ownership. However the state does not charge this capital gains tax on the sale of traditional currency no matter how much it might have inflated.

Idaho collects a state income tax at a maximum marginal tax rate of spread across tax brackets. Does Idaho have an Inheritance Tax or an Estate Tax. Only losses from qualifying property can be used to reduce your capital gain.

If you have paid any taxes already. Idaho does not have a special tax rate for gains and losses on stocks bonds or other intangibles. In addition to needing to be your primary residence you will need to have lived in the house for at least two of the past five years.

The capital gains rate for Idaho is. The table below summarizes uppermost capital gains tax rates for Idaho and neighboring states in 2015. The land in Idaho originally cost 550000.

Positive feedback is also greatly appreciated. 208 334-7660 or 800 972-7660 Fax. Capital gains taxes on assets held for a.

Should I Refinance My Mortgage. In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on most assets held for longer than a year. State Tax Commission PO.

Mary must report 55000 of Idaho source income from the gain on the sale of the land computed as follows. Subscribe to our Newsletter. The Idaho Income Tax.

Precious metals in bullion form are a constitutional form of money and should be treated as such when it comes to taxation. The land in Utah cost 450000. For tangible personal property.

100000 gain x 5500001000000 55000. Thanks for the question and have a. 208 334-7846 taxrep.

If you have any capital gain in the current year and any capital loss carryover from a prior year you must reduce your capital gain by the carryover loss. 500000 for married couple - will not be taxable. At Closing on September 1st you have owned the property for 244 days of the year and owe 244 x 822 200548.

Ad Free Online Tax Tutorial - Tax Consultant Certification - Be Certified Tax Consultant 100. Wages salaries 100000 Capital gains - losses -50000. Days the property was used in Idaho Days the property was used everywhere.

State Tax Commission PO. Section 63-3039 Idaho Code Rules and Regulations Publication of Statistics and Law Who do I contact for more information on this rule. Calculate Your Capital Gains Tax.

If you found this answer helpful please press the accept button. Like the Federal Income Tax Idahos income tax allows couples filing jointly to pay a lower overall rate on their combined income with wider tax brackets for joint filers. Object Moved This document may be found here.

Box 36 Boise ID 83722-0410 Phone. Become Certified Tax Consultant Quickly - Tax Consulting Learning Free Updated 2022. Capital Gains Tax Calculator 2022.

Idaho does not levy an inheritance tax or an estate tax. Section 63-3039 Idaho Code Rules and Regulations Publication of Statistics and Law Who do I contact for more. Idaho does not levy an inheritance tax or an estate tax.

Use Form CG to compute an individuals Idaho capital gains deduction. Lets say you sold your Virginia Home on September 1st and your annual taxes due are 3000. The Idaho capital gains deduction cant exceed the capital gain net income reported on the federal return.

Keep in mind that if you inherit property from another state that state may have an estate tax that applies. Uppermost capital gains tax rates by state 2015 State State uppermost rate Combined uppermost rate Idaho. Your income and filing status make your capital gains tax rate on real estate 15.

HB 449 would eliminate the state capital gains tax on the sale of precious metals. The District of Columbia moved in the. Does Idaho have an Inheritance Tax or an Estate Tax.

Idahos maximum marginal income tax rate is the 1st.

Idaho Estate Tax Everything You Need To Know Smartasset

Historical Idaho Tax Policy Information Ballotpedia

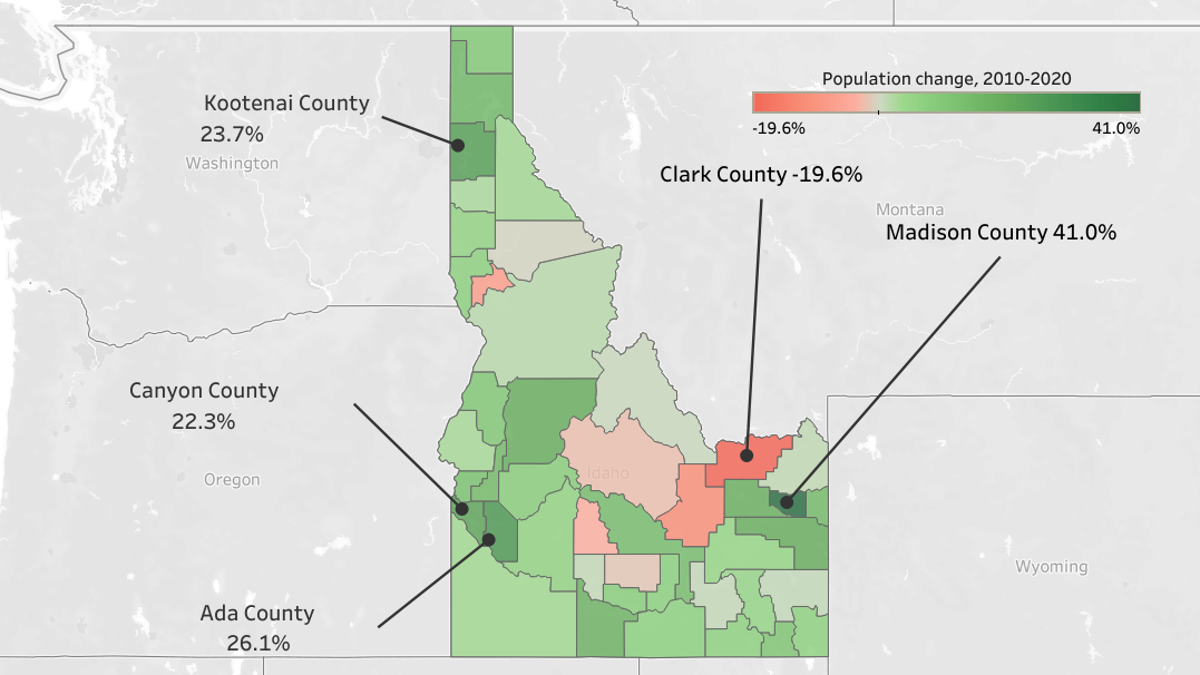

Idaho Remains Fastest Growing State Utah Second News Tetonvalleynews Net

Idaho Doesn T Review Its Tax Exemptions Billions Go Uncollected Annually Report Says Idaho Capital Sun

Idaho Income Tax Calculator Smartasset

Mapsontheweb Kansas Missouri Wyoming North Washington

Taxes 1099 R Public Employee Retirement System Of Idaho

Idaho Opportunity Zones Oz Funds Investing Id Tax Benefits

Idaho Tax Forms And Instructions For 2021 Form 40

Top 4 Renovations For The Greatest Return On Investment Infographic Investing Infographic Renovations

Idaho Student Loan Forgiveness Programs

Capital Gains Tax Idaho Can You Avoid It Selling A Home

Capital Gains Tax Idaho Can You Avoid It Selling A Home

Idaho Income Tax Calculator Smartasset

Where Upper Middle Class People Are Moving Upper Middle Class Middle Class Financial Advice

Oregon Republicans Petition Counties To Join Idaho The Washington Post